Where Does the Tax Money Come From?

How does growth weigh on tax money?

The state of Arizona hands out tax money to Dewey-Humboldt through a shared revenue program for incorporated cities and towns. This funding mechanism, which is based largely on population, provides the town with portions of statewide tax collections.

Key sources of shared revenue for Dewey-Humboldt can include:

- State Transaction Privilege Tax (TPT): A portion of state sales tax collections are distributed to municipalities based on their population. These funds can be used for any general municipal purpose.

- Urban Revenue Sharing (URS): This fund, made up of 18% of state income tax collections, is distributed to cities and towns based on their population. The funds can be used for any municipal public purpose.

- Vehicle License Tax (VLT): Approximately 20% of VLT revenues are distributed to cities and towns based on the county of origin of registrations and the municipality’s population within that county. These funds can be used for any municipal public purpose.

- Highway User Revenue Fund (HURF): Revenue from fuel taxes, vehicle fees, and a portion of VLT is distributed to cities and towns, with the allocation based on population and gasoline sales from the county of origin. HURF revenue is restricted for street and highway expenditures.

Population is a critical factor for Dewey-Humboldt’s share of TPT, URS, and HURF distributions. Yavapai County property taxes are collected for the town but are separate from the state-shared revenue program. If one town in the collection grows faster than the other, they will see more money in the future. If the above tax revenue goes down because of the economy, so does the amount the town will see.

How Are Yavapai County Property Taxes Collected & Handled?

In Dewey-Humboldt, property taxes are handled and collected by Yavapai County, not the Town of Dewey-Humboldt. The county is responsible for assessing property values, billing, and collecting the taxes, which then funds various jurisdictions, including the town.

How property taxes are determined

Multiple tax entities: Property tax bills in Yavapai County include levies for several jurisdictions, not just the county itself. These can include school districts, special districts (such as for flood control), and the Town of Dewey-Humboldt. See your tax bill for more information.

Valuation: The Yavapai County Assessor’s Office determines a property’s market value, from which an assessed value is calculated.

Tax rates: The property tax rate is determined by the budgets set by various taxing jurisdictions. It is then applied to the property’s assessed value to calculate the final tax bill.

The Town of Dewey-Humboldt only sees a small portions of the property tax money after Yavapai County accounts for their share of our taxes.

https://www.yavapaiaz.gov/Mapping-and-Properties/Property-Taxes

Does Growth Help or Hurt?

Growth is a double edge sword. When competing against towns and cities like Chino, Prescott Valley, Prescott, Cottonwood, etc. The larger populations gets more of the tax pie. Other government agencies and the State of Arizona doesn’t tell us to grow. As an incorporated town, our citizens decide to grow or not. Many like the rural feeling of the town but the lack of growth will cause less tax money for the town’s needs. Places like Prescott Valley will continue to grow and take more of the pie.

Something to think about – If growth is what we want? Can we grow enough to keep our piece of the pie or add to it? Places like Prescott and Prescott Valley have more land to build to attract far more people. The Town of Dewey-Humboldt has less than 6,000 residents, currently Prescott Valley has over 50,000 residents and growing. It is the population, not the actual buildings, that help get tax money through the shared revenue program.

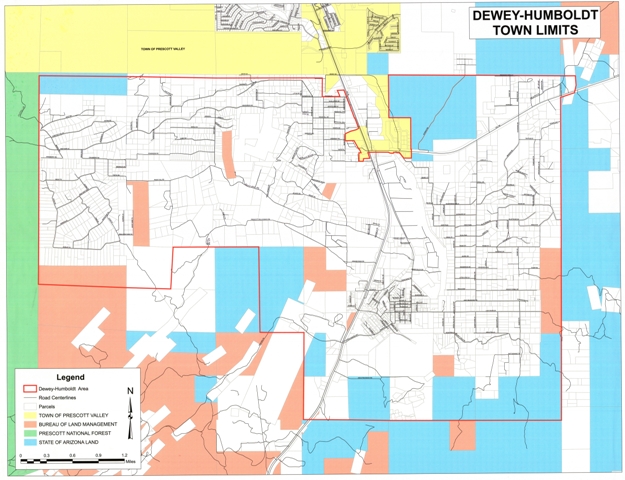

Town of Dewey-Humboldt Boundaries