Want to enjoy the Small Town Life? Start a Farm!

In Arizona, turning a property into agriculture involves meeting strict criteria for classification under state law, primarily the Arizona Revised Statutes (A.R.S.) Title 42, which deals with taxation. A property owner must demonstrate a commercial agricultural operation with a reasonable expectation of profit to receive a reduced property tax valuation.

Eligibility requirements

To have a property classified for agricultural use, you must meet the following criteria:

- Primary agricultural use: The property’s primary function must be agricultural.

- Active production: The land must have been in active commercial production according to generally accepted agricultural practices for at least three of the last five years.

- Reasonable expectation of profit: There must be a reasonable expectation of operating profit from the agricultural use, exclusive of the land cost.

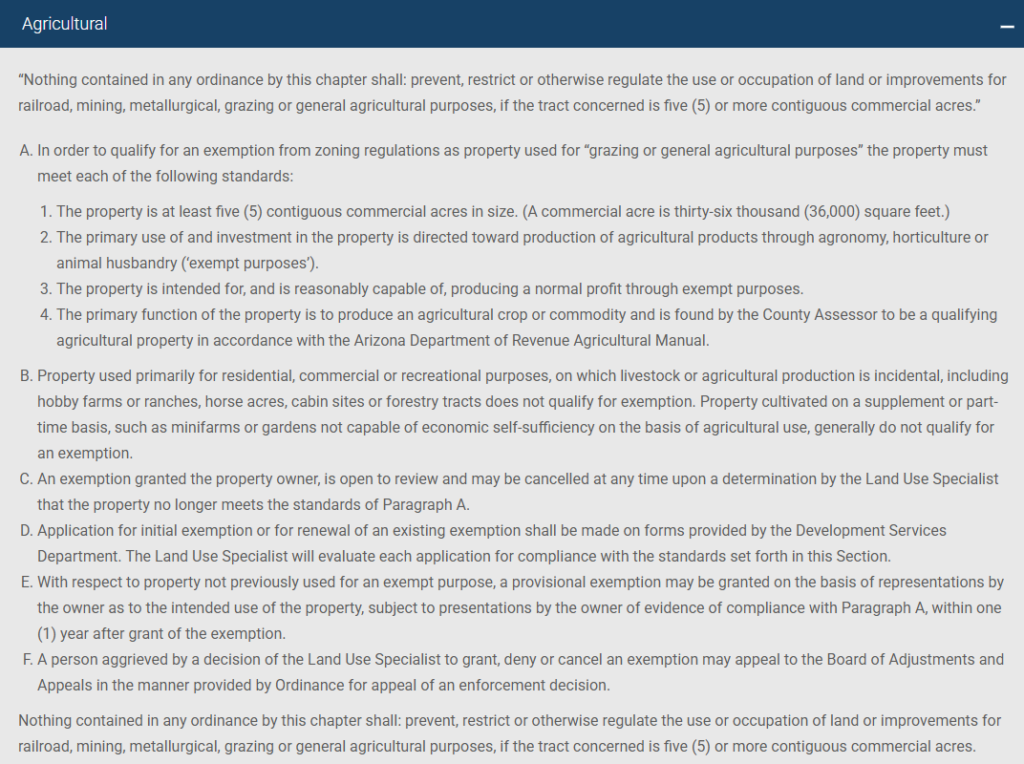

standards FROM YAVAPAI

ttps://www.yavapaiaz.gov/Development-and-Permits/Development-Services/Planning-Unit/Exemptions

**Contiguous land refers to parcels of land that are adjoining or touch at a common boundary, either directly or by being separated only by a public right-of-way like a road or street. It indicates a continuous plot of land, even if it is made up of multiple parcels, as long as they are under the same ownership and connected.

Application process

The official classification is handled by the county assessor’s office based on a specific application and review process:

- File an application: Submit an Agricultural Land Use Application (DOR Form 82916) to your county assessor. If you are leasing the property, an Agricultural Lease Abstract (DOR Form 82917) must also be filed.

- Assessor review: The assessor’s office will review the application and determine if the property meets the criteria in A.R.S. §§ 42-12151 and 42-12152.

- Timeframe: Applications are typically reviewed within 120 days. An application for the current tax year must be received by May 15th; otherwise, it will be applied to the next valuation tax year.

- Leased property: If you purchase a property that already has an agricultural classification, you must file new agricultural forms within 60 days of the purchase to maintain the classification.

Important considerations

Valuation vs. exemption:

Valuation vs. exemption: An agricultural tax classification is different from a land use exemption for zoning or permitting. Having one does not automatically grant the other. You must consult both the county assessor and the planning and development department of your City/Town/County.

Water rights

Water rights: Due to Arizona’s groundwater regulations, particularly in Active Management Areas, land without grandfathered groundwater rights may not qualify as cropland, or its water supply may be temporarily reduced.

Penalties

Penalties: If a property with an agricultural classification is sold or converted to another use, it may be subject to a recapture tax.

Resource: https://www.azleg.gov/ars/42/12152.htm#:~:text=42%2D12152%20%2D%20Criteria%20for%20classification,use%20in%20the%20farm%20unit.

https://www.yavapaiaz.gov/Development-and-Permits/Development-Services/Planning-Unit/Exemptions